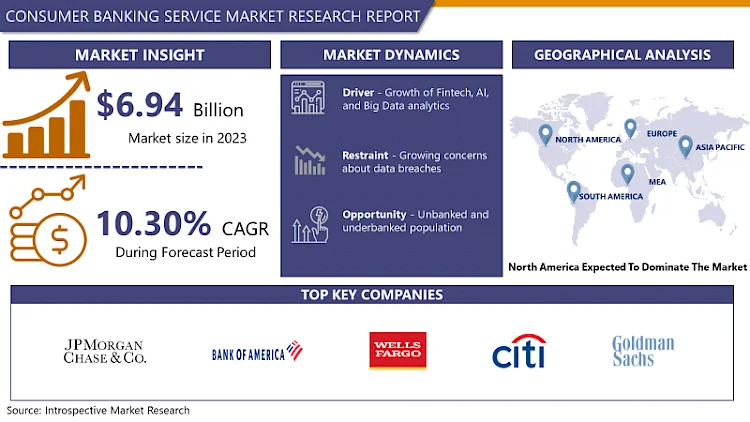

Consumer Banking Service Market Size Was Valued at USD 6.94 Billion in 2023, and is Projected to Reach USD 16.77 Million by 2032, Growing at a CAGR of 10.30% From 2024-2032.

Consumer banking service market encompasses more than a few financial offerings supplied through banks to individual clients. These offerings encompass personal savings and checking debts, credit score and debit cards, mortgages, non-public loans, and wealth management solutions. With the rise of virtual transformation, many banks at the moment are providing on line and cell banking offerings, allowing clients to carry out transactions, manage money owed, and access monetary products from their smartphones or computers.

Challenges inside the purchaser banking service marketplace include regulatory compliance, statistics privateness concerns, and the need for banks to continuously innovate to stay competitive. In many areas, in particular in emerging markets, there may be also a push for monetary inclusion, bringing banking offerings to underserved populations.

For more insights on the historical and Forecast market download a sample report

https://introspectivemarketresearch.com/request/14875

Top Key Players:

JPMorgan Chase & Co. (New York, USA), Bank of America Corporation (Charlotte, USA), Wells Fargo & Company (San Francisco, USA), Citigroup Inc. (New York, USA), Goldman Sachs Group Inc. (New York, USA), Morgan Stanley (New York, USA), Royal Bank of Canada (Toronto, Canada), Toronto-Dominion Bank (Toronto, Canada), Scotiabank (Toronto, Canada), Bank of Montreal (BMO) (Montreal, Canada), HSBC Holdings plc (London, UK), Barclays plc (London, UK), Lloyds Banking Group (London, UK), UBS Group AG (Zurich, Switzerland), Credit Suisse Group AG (Zurich, Switzerland), BNP Paribas (Paris, France), Deutsche Bank AG (Frankfurt, Germany), Santander Group (Madrid, Spain), Mitsubishi UFJ Financial Group (Tokyo, Japan, Sumitomo Mitsui Financial Group (Tokyo, Japan) and Other Major Players.

Market Dynamics:

Drivers Of Consumer Banking Service Market

The Consumer banking Servicemarket is propelled by the fast digitalization of banking operations, as extra consumers shift towards on-line and mobile systems for coping with their finances. This shift is supported by way of vast internet and telephone adoption, which makes banking services more accessible. The emergence of fintech businesses has further fueled the marketplace, using traditional banks to innovate and enhance consumer enjoy by integrating superior technology like artificial intelligence (AI) and device learning (ML). These technology assist banks offer customized offerings, automate recurring obligations, and improve customer service. Additionally, open banking projects are growing an extra aggressive panorama by allowing information sharing, which allows consumers to get entry to a broader range of financial products and services.

Opportunities of The Consumer banking Service market

The Consumer banking Servicemarket affords substantial opportunities driven by using the continuing digital transformation and the increasing adoption of advanced technology. The shift in the direction of cell and on line banking offers banks the danger to attain a wider consumer base, particularly in underserved and far flung regions. Open banking frameworks offer further possibilities through fostering innovation and allowing the improvement of new financial products thru information sharing. Personalized banking, enabled by means of AI and device mastering, allows banks to tailor services and products to man or woman desires, enhancing patron delight and loyalty. The developing demand for seamless, real-time banking experiences offers opportunities for banks to put money into person-pleasant virtual systems and beautify cellular app functionalities.

Segmentation Analysis of Consumer Banking Service Market

By Type

- Traditional

- Digital Led

By Application

- Transactional Accounts

- Savings Accounts

- Debit Cards

- Credit Cards

- Loans

- Others

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Acquire this Market Research Report Now:

https://introspectivemarketresearch.com/checkout/?user=1&_sid=14875

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736